Blueberries comprise a hefty serving of Georgia’s fruit industry, as increased production and demand stack up profits in the Peach State.

Georgia ranks third nationally for both blueberry and peach production however the blueberry far outstrips its fuzzy cousin, with the blueberry industry contributing $348.7 million to Georgia’s economy in 2021 compared to $84.8 million from the peach industry, according to the CAES Center for Agribusiness and Economic Development in the 2023 Ag Snapshots.

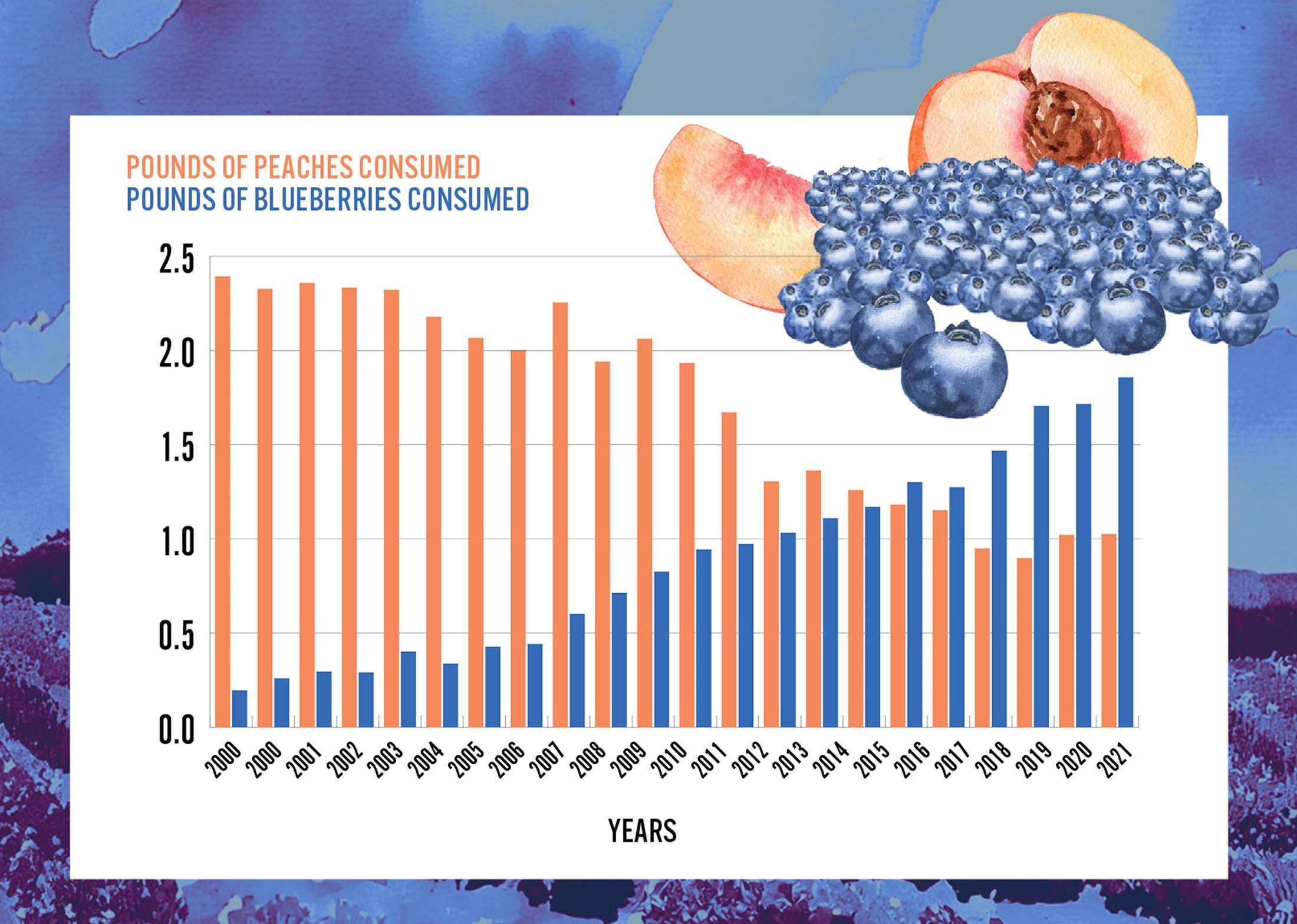

While berry consumption has grown, Campbell added that it has most likely been at the expense of other Georgia commodities. As blueberry demand has increased, he said, peach demand is down 47%.

Ben Campbell, Associate Professor in the Department of Agricultural and Applied Economics, University of Georgia

Greg Fonsah, Professor in the Department of Agricultural and Applied Economics, University of Georgia

Per capita consumption has been increasing steadily, Fonsah added, jumping from 1.58 pounds in 2015 to 1.71 pounds in 2016.

“It is worth mentioning that due to consumer demand for blueberries and the increase in production in Georgia and the United States in general, the supply is not enough to meet domestic demand,” Fonsah said. “Barely 50 million pounds of blueberries penetrated the U.S. market from foreign countries in 2005, compared to 400 million pounds in 2018.”

In addition to the increased demand for blueberries, researchers are monitoring consumer preferences on a broader scale.

“Berries as a category have seen tremendous growth over the last decade, but it has not just been for blueberries,” Campbell said. “Raspberries have experienced a 192% increase in consumption. So, on the consumer side, economists are watching consumer preferences as they change over time and gravitate to new products or varieties.”

Tracking The Success Of A Top 10 Georgia Commodity

AI image of blueberry field generated by Adobe Firefly

“For instance, over two decades ago, there were four kinds of agricultural practices adopted for blueberries in the state of Georgia — rabbiteye, southern highbush, high density and organic blueberry production systems, respectively,” Fonsah said. “Presently, the high-density production system is no longer popular, while machine harvesting is increasing due to the problems caused by labor shortage.”

Seasonality and the impact of trade are drivers of current research, according to Campbell.

“We’re looking at seasonality — competition from other states such as Florida and North Carolina and how Georgia product fits within marketing windows,” Campbell said. “We also focus on the impact of trade; much like seasonality, when does product from other countries hit the market and cause Georgia prices to decrease.”

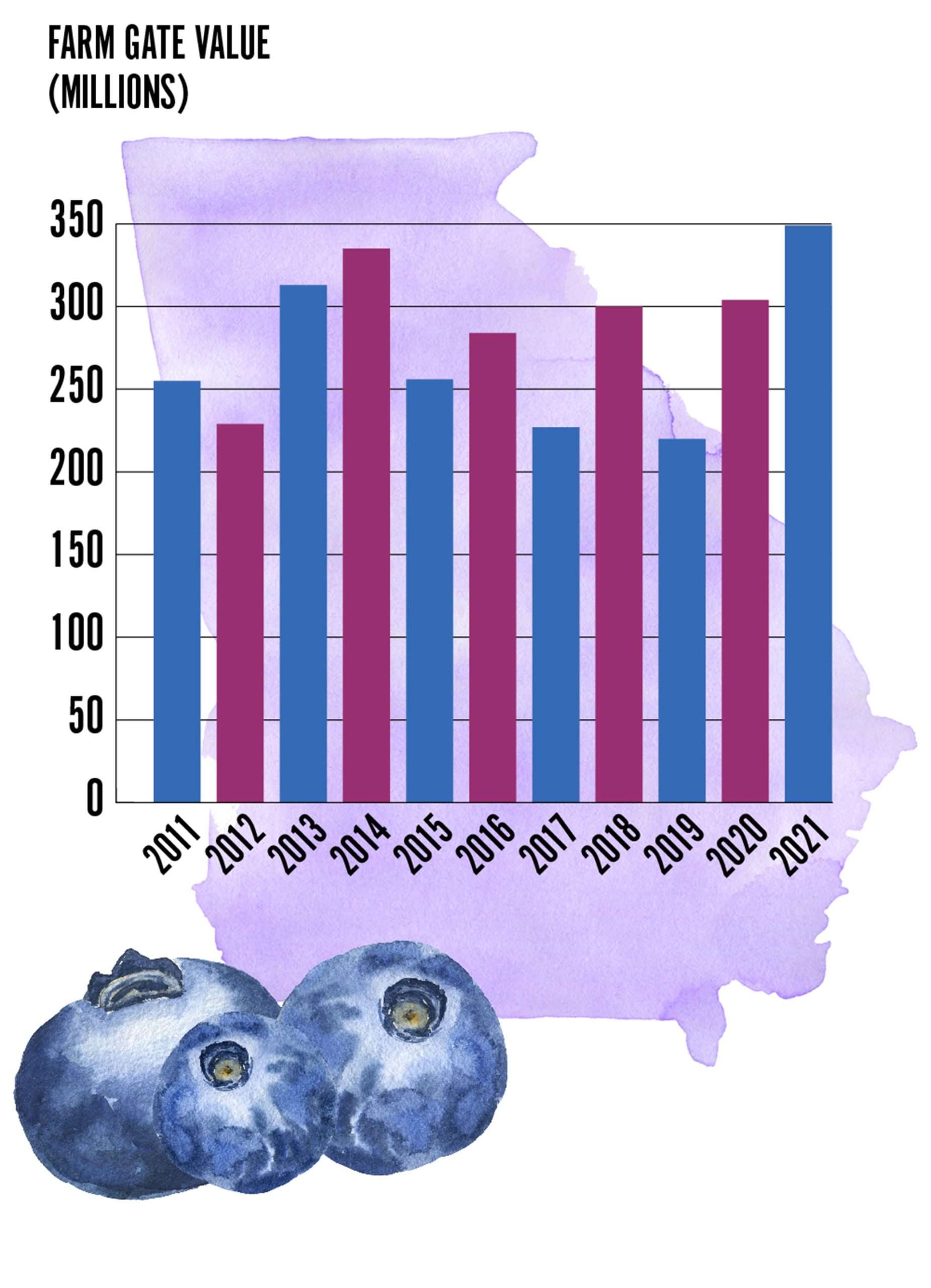

Farm gate value graph of blueberries in Georgia, from 2011-2021

Still, data shows a 14% increase in the farm gate value for blueberries from 2011 to 2021. Adjusting for inflation, the increasingly popular berry rose from $306 million to $348 million in value. In the same period, total blueberry acreage increased by 11% from roughly 21,300 acres in 2011 to almost 25,000 acres in 2021, according to Campbell.

“All acreage is not the same, however; fresh highbush has increased by 83% in the last decade while rabbiteye has decreased by 22%,” Campbell said. “Prices, on the other hand, have increased by 4% and 5% for fresh highbush and rabbiteye, respectively, so most of the increased farm gate value is coming from increases in volume, not a price increase.”

Even so, Fonsah said fresh blueberry prices have been one of the drivers of the increase in production.

To learn more about UGA blueberry research, resources and news, visit the UGA Extension blueberry page.