A new study on behalf of Trace One has identified the potential impact of import tariffs and foreign good shortages on the U.S. food supply.

Donald Trump’s recent plan to impose a 25% tariff on imports from Mexico and Canada, along with an additional 10% tariff on goods from China, could have significant consequences for U.S. consumers. Together, these three countries supply nearly half (45%) of all U.S. food and beverage imports, making everyday staples more vulnerable to rising prices.

Currently, the U.S. imports nearly a fifth of its food supply from abroad, and the average American household spends nearly 14% of its annual budget on food and beverages. For many, this is already a burden—28% of U.S. adults report difficulty affording food, and 13.5% of households are classified as food insecure, meaning they lack reliable access to sufficient nutrition.

To better understand the potential impact of import tariffs and foreign good shortages on the U.S. food supply, researchers at Trace One, a company specializing in regulatory compliance for the food and beverage industry, analyzed the most recent data from the USDA, U.S. Census Bureau, and U.S. Bureau of Economic Analysis. Their focus was on tracking changes in food imports over time, examining food imports as a percentage of total consumption, identifying key trade partners, and highlighting the top imports for each state. For more information on the data sources and methodology, refer to the methodology section.

U.S. Agricultural Imports & Exports

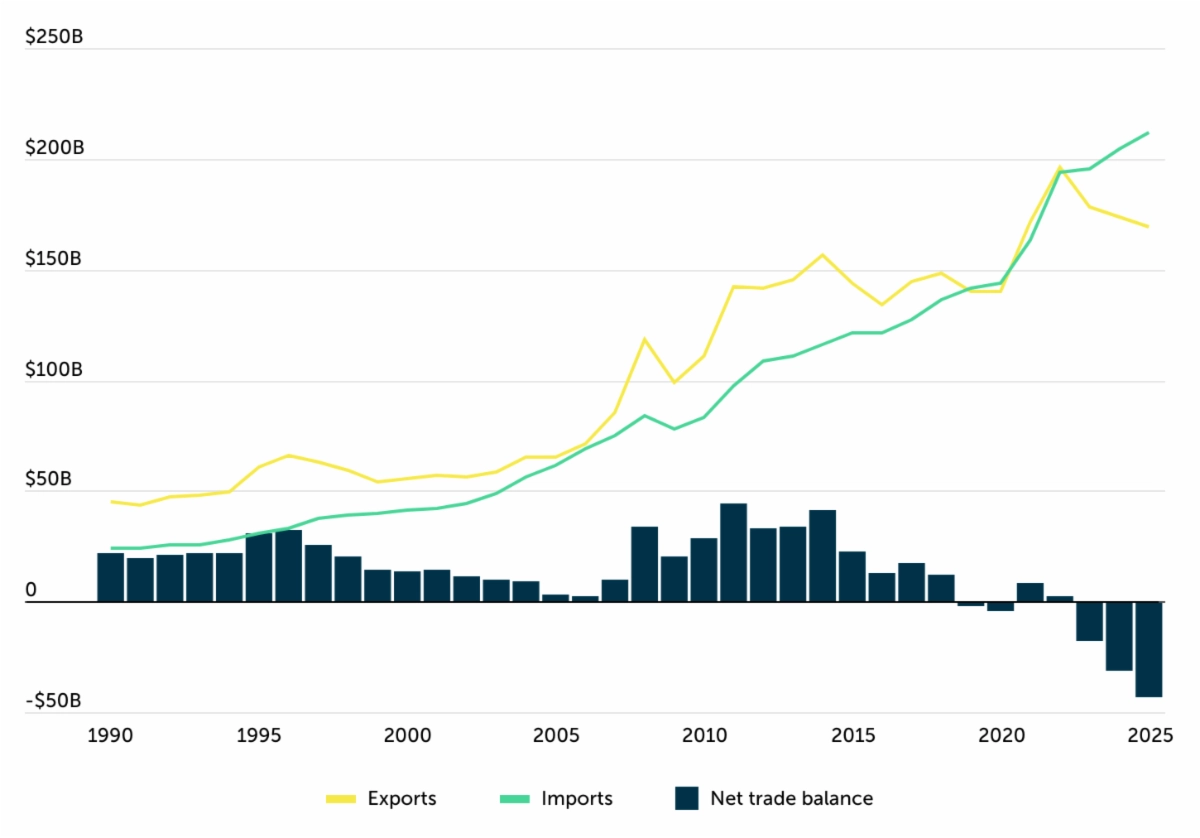

USDA forecasts $42B agricultural trade deficit in 2025

Trace One analysis of USDA data

The U.S. has traditionally exported more agricultural goods than it imported, but this balance has shifted in recent years as import growth has outpaced exports. Demand for imported goods has surged, driven by factors such as a strong U.S. dollar and consumer preferences for year-round access to fresh produce.

Looking ahead, the USDA forecasts a $42 billion agricultural trade deficit in 2025, which would be the largest on record in at least the past three decades. U.S. agricultural exports are expected to decline to $169.5 billion, a $4 billion drop from the previous year, due to falling prices for key commodities like soybeans, corn, and cotton, as well as reduced beef exports. Meanwhile, agricultural imports are projected to rise to $212 billion, driven by increasing demand for produce and sugar.

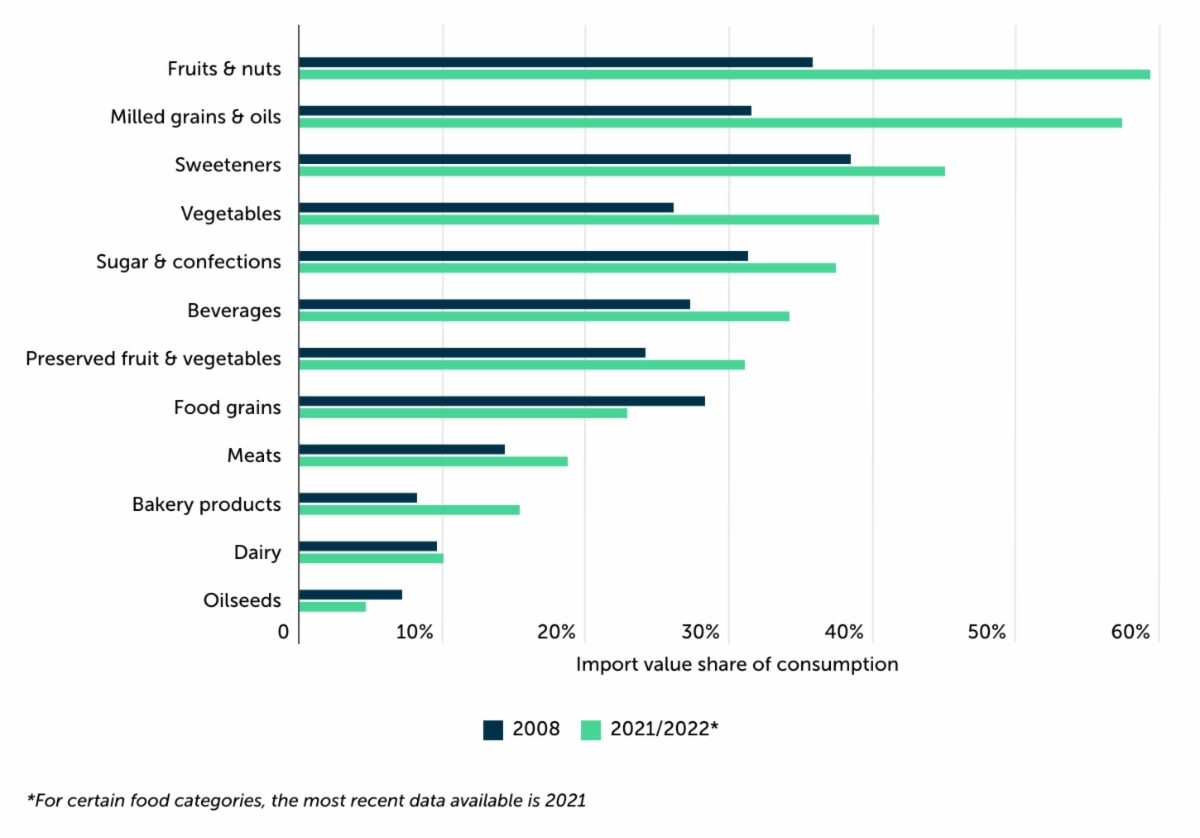

Imports as a Share of Consumption by Food Category

Nearly 60% of fruits & nuts consumed in the U.S. are imported

Trace One analysis of USDA data

Imported foods have become an increasingly significant part of the American diet, with the share of imported goods rising across nearly every food category in recent years. Between 2008 and 2022, the percentage of total food and beverages consumed in the U.S. that were imported increased from 12.4% to 17.3%. However, this growing reliance on imported food has been particularly pronounced in certain categories.

Fruits and nuts stand out as one of the most import-dependent categories, with nearly 60% of the fruits and nuts consumed in the U.S. now coming from abroad, up from 35.8% in 2008. Similarly, imports of milled grains and oils have grown sharply, now accounting for 57.4% of consumption, compared to 31.5% in 2008. Other categories like sweeteners and vegetables have also seen notable increases, with imports now constituting 45.0% and 40.4% of consumption, respectively.

In addition to these categories, the U.S. is heavily reliant on imports for seafood, with an estimated 70–85% of seafood consumed domestically coming from international sources. As tariffs and trade policies potentially shift, these high levels of dependency on imported goods could have a direct impact on food prices at the consumer level.

The post Which Foods Are Most Vulnerable to Import Tariffs? originally appeared in the PLM Compliance Blog.

Methodology

The data used in this study comes from the USDA’s Economic Research Service, U.S. Census Bureau’s USA Trade Online, U.S. Census Bureau’s Household Pulse Survey, and U.S. Bureau of Economic Analysis’s Consumer Spending by State.

The top food and beverage import commodities for the U.S. overall, by country, and by state were determined as those with the greatest import value in 2023 based on six-digit Harmonized System (HS) commodity codes. Where applicable, commodity descriptions were updated to improve readability. The following HS commodity categories were included: 02; 03; 04; 07; 08; 09; 10; 11; 12; 13; 15; 16; 17; 18; 19; 20; 21; 22.

The percentage of adults experiencing food affordability challenges was sourced from the Household Pulse Survey Phase 4.2 Cycle 09. This figure represents the proportion of respondents who reported being unable to afford more food. State-level data on food insecurity covers the period from 2021 to 2023, while national-level data reflects conditions in 2023 alone.

Written by Federico Fontanella, PMP

Federico is a Product Manager with background in Software Engineering and more than 15 years of experience in software development, project management, and product management. In his role as Sr. Director of Product Management at Trace One, Federico applies his strong software engineering background coupled with excellent understanding of business and market needs to define new product categories, improve business processes, and innovate solutions. Specialties: Product Management, Project Management, Software Development, Strategy

Trace One is a global leader with over 30 years of experience specializing in regulatory compliance and PLM solutions for the food and beverage industry. Its work has been featured in Newsweek, MSN, USA Today, ABC, and more. Additional insights are available upon request.