Food waste continues to be a significant concern in the United States, presenting both financial and environmental challenges. According to government estimates, between 30% and 40% of the nation’s food supply is wasted annually, translating to millions of tons—and billions of dollars—lost. This not only impacts individual household budgets but also exacerbates economic inefficiencies and environmental degradation, contributing to air pollution, soil and water degradation, and greenhouse gas emissions.

The national goal of reducing food waste by 50% by 2030 underscores the urgency of addressing this issue. In 2024, a collaborative agreement between the FDA, EPA, and USDA aimed at reducing food waste marked a significant step toward achieving this target. The recently unveiled National Strategy for Reducing Food Loss and Waste and Recycling Organics details the coordinated actions these agencies will take to tackle the problem.

Achieving a 50% reduction in food waste is important for enhancing food security, lowering greenhouse gas emissions, and saving money. However, this goal necessitates substantial changes across the entire food supply chain, with a particular emphasis on consumer behavior. While policymakers and agencies are actively working on solutions, the participation of individuals, households, and businesses will be vital to making meaningful progress.

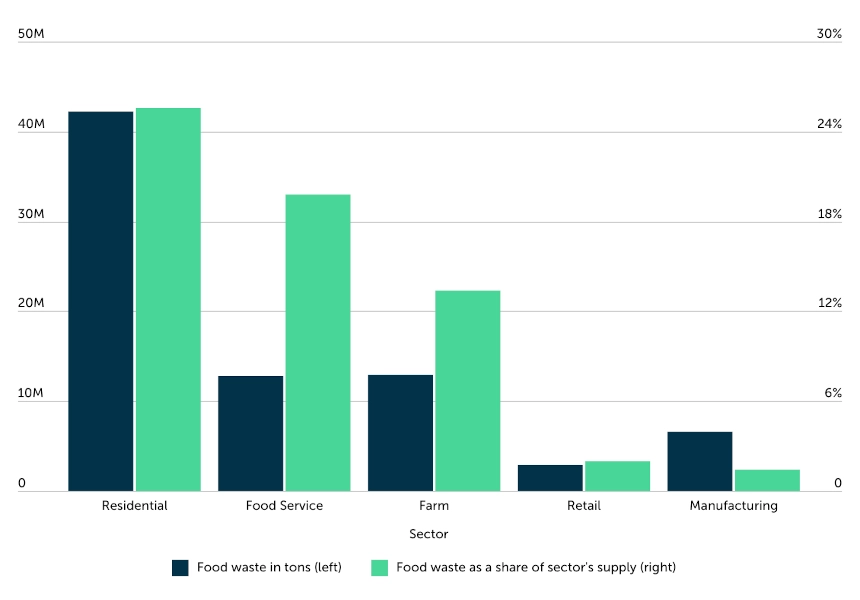

U.S. Food Waste by Sector

The residential sector is responsible for the majority of food waste in the U.S.

Source: Trace One analysis of ReFED data

While sectors like food service and farms each generate over 10 million tons of food waste annually, U.S. households are the largest contributors, producing more than 42 million tons of food waste each year. This residential waste represents approximately 25% of the sector’s food supply. In contrast, retail and manufacturing sectors waste a much smaller percentage of their supply, with retail at about 2% and manufacturing at 1.4%.

Retailers and manufacturers have strong incentives to minimize waste, as they operate on tight margins and possess resources to invest in waste reduction technologies. These sectors benefit from advanced data collection, forecasting models, and product lifecycle management systems, which help them reduce waste and improve profitability.

In other sectors, the relationship between food waste and profitability is more complex. For instance, in the food service industry, most waste comes from plate waste, which has already been paid for by customers. Similarly, in the farming sector, federal subsidies can obscure the link between production levels and profitability, making waste reduction less directly impactful on their bottom line.

LEARN MORE

Interested in reducing the environmental impacts of your products beyond just waste reduction? Technologies like product sustainability software provide a holistic view of each product’s ecological impacts, such as energy use, water consumption, and carbon footprint.

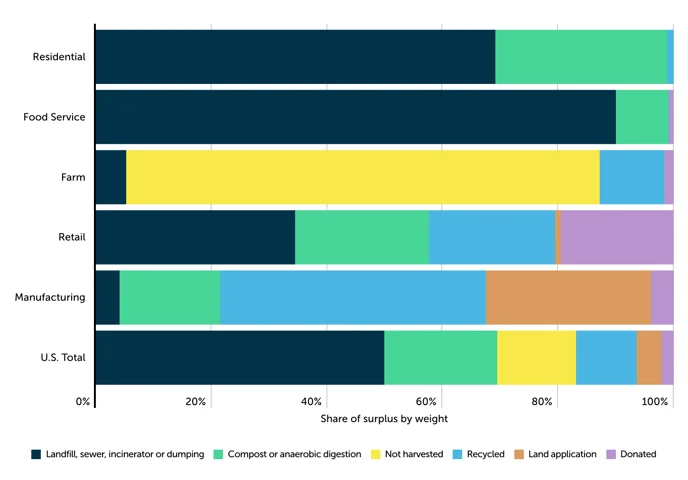

What Happens to America’s Excess Food?

Food manufacturers and retailers use more environmentally friendly pathways for dealing with excess food.

Major sectors in the U.S. differ not only in the amount of food they waste but also in their methods of handling excess food, which have significant environmental implications. The EPA’s Wasted Food Scale rates disposal methods from most to least preferred based on environmental impact. The preferred methods include preventing waste, donating, or upcycling food, while the least preferred methods involve disposing of food in drains, landfills, or incinerators.

Despite these guidelines, nearly half of the excess food in the U.S. is discarded in landfills or the like. In the residential and food service sectors, which generate the most excess food, the rates of food being sent to these locations are 70% and 90%, respectively. Conversely, other major sectors like farms, retail, and manufacturing adopt more diverse and environmentally friendly approaches, such as recycling, composting, and donating food to those in need.

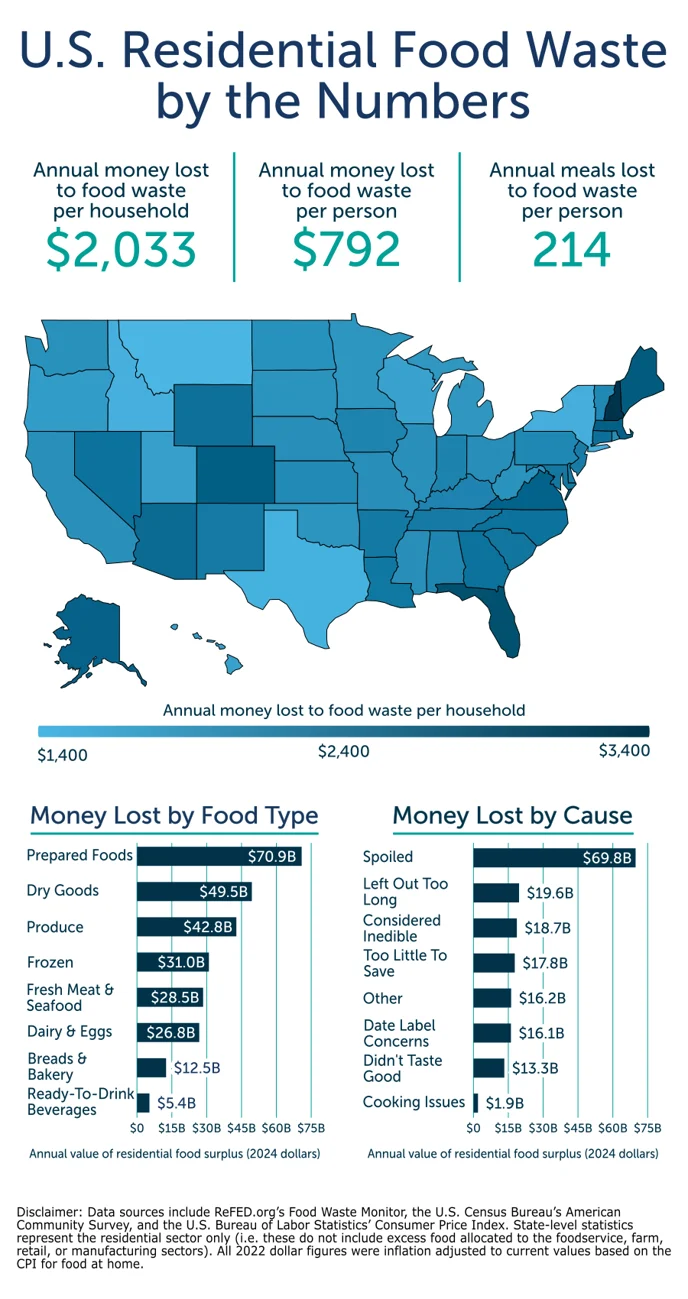

U.S. Household Food Waste

Credit: Trace One

Not every household may be thinking about the environmental impacts of their wasted food, but many more might be surprised to learn the extent of food waste’s financial impacts. On average, U.S. households lose more than $2,000 per year to food waste, while individuals lose an average of $792—the equivalent of 214 meals.

Overwhelmingly, the primary cause of food waste in the residential sector is spoilage, accounting for $69.8 billion of waste each year. Other potential food safety issues like leaving food out too long or food mistakenly being considered inedible also rank highly as causes of waste. Prepared foods ($70.9 billion), dry goods ($49.5 billion), and produce ($42.8 billion) are the types of foods with the most money lost to waste each year by U.S. households.

While food waste is a major nationwide problem, households in certain parts of the U.S. are more likely than others to lose money to food waste as a result of differences in food prices and purchasing patterns. In New Hampshire, households lose $3,363 to waste each year—which is more than 1.5 times higher than the national average—and other nearby New England states like Maine, Massachusetts, and Connecticut also rank in the top 10.

Western states tend to lose less money to food waste. In Montana, households lose the least at just $1,450 per year, while other states like Idaho, Utah, and Oregon also have levels of food waste below the national average.

Methodology

This analysis was conducted by Trace One—a company providing PLM and compliance software for food and beverage manufacturers and CPG retailers—using data from ReFED.org’s Food Waste Monitor, the U.S. Census Bureau’s American Community Survey, and the U.S. Bureau of Labor Statistics’ Consumer Price Index. State-level statistics represent the residential sector only (i.e. these do not include excess food allocated to the food service, farm, retail, or manufacturing sectors). All 2022 dollar figures were inflation-adjusted to current values based on the CPI for food at home.

The post Where Americans Lose the Most Money to Food Waste originally appeared in the PLM Compliance Blog.

Written by Federico Fontanella, PMP

Federico is a Product Manager with background in Software Engineering and more than 15 years of experience in software development, project management, and product management. In his role as Sr. Director of Product Management at Trace One, Federico applies his strong software engineering background coupled with excellent understanding of business and market needs to define new product categories, improve business processes, and innovate solutions. Specialties: Product Management, Project Management, Software Development, Strategy